Companies in the financial sector place extremely high demands on their call center. The complicated and sensitive nature of the calls handled requires an agent who is highly trained and experienced. This, in turn, leads to a high cost-per-call. At the same time, customer relationships are long-lasting so sacrificing caller satisfaction in the short-term is not an option.

Companies in the financial sector place extremely high demands on their call center. The complicated and sensitive nature of the calls handled requires an agent who is highly trained and experienced. This, in turn, leads to a high cost-per-call. At the same time, customer relationships are long-lasting so sacrificing caller satisfaction in the short-term is not an option.

This creates a tough challenge: How do you decrease the cost-per-call while improving the customer experience? Here are three contact center trends that financial companies must keep in mind.

1) KPIs Continue to Stay Above Industry Average

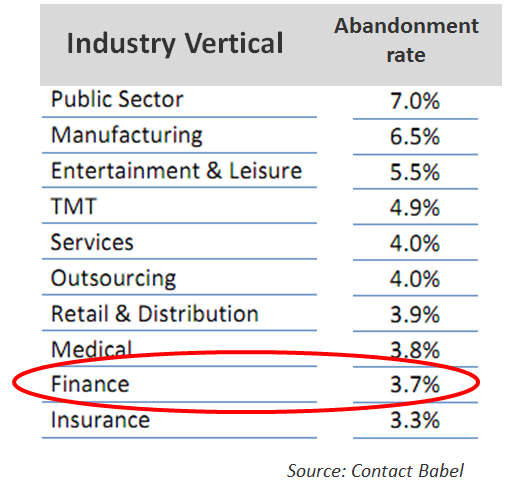

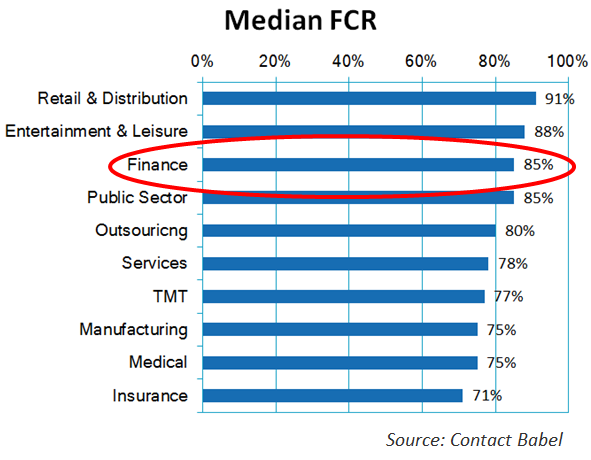

The FinServ industry is known for scoring well on the core call center metrics, and this pattern is continuing. In the most recent edition of Contact Babel’s industry survey, this sector had the second-lowest abandonment rate and “Average Speed to Answer” (ASA) of the 10 industry categories covered.

Many people consider “First Call Resolution” (FCR) to be the most important metric of call center effectiveness (even though it’s more subjective than ASA and abandonment). On this front, financial companies also do well, scoring the 3rd highest of the group.

2) Voice Biometrics

With key metrics like FCR, ASA and abandonment already quite optimized, where is the industry hoping to find additional improvements? What “low hanging” fruit remains for finding a significant reduction in cost-per-call? The answer is caller authentication. This is an area of focus for leaders across the industry.

The reason for the focus is obvious. At Bank of America, for example, identity verification consumes 25% of the average call time. For the financial services industry as a whole, 79% of all calls require authentication and that process consumes an average of 20 seconds of each call.

The leading candidate for solving this problem is voice biometrics. More and more deployments are showing that this technology is ready for prime time. Some large financial institutions, such as Barclay’s Wealth and Investment, have already deployed it.

3) Mobile Banking

The latest numbers from Comscore confirm that the steady march towards smartphone domination is continuing. 234 million Americans age 13 and up use mobile devices, and 47% of them use a smartphone. As smartphones become ubiquitous, we are reaching a point where we can start to rethink this device as the front-end for call centers.

Steve Beasty from Bank of America said recently:

The two channels which have the most integration points are mobile and contact centers. So, for example, if a customer is on their mobile device, yet needs to access our expertise, they can now transition from mobile banking to speaking with a contact center agent quickly and fully authenticated.

Large banks aren’t the only ones embracing mobile customer service. The San Diego County Credit Union has a very ambitious mobile offering. Their CEO, Teresa Halleck, sees it as a top priority, saying recently:

Financial institutions must continue to offer mobile customer service solutions.

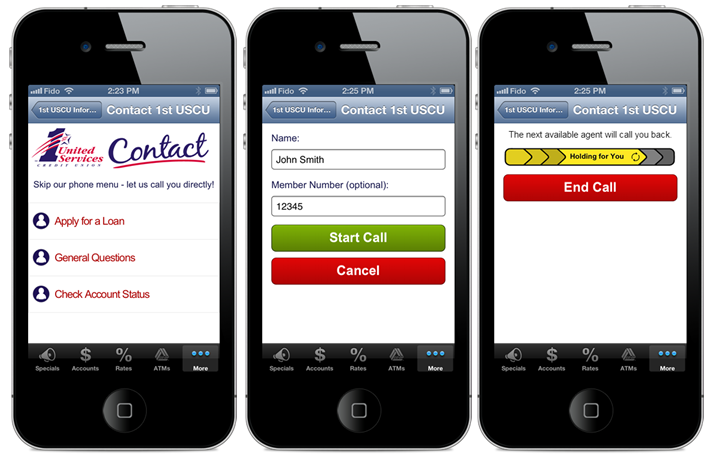

California’s 1st United Services Credit Union is also worth mentioning. They recently deployed a mobile app for iPhone and Android that includes Web Call-Backs (formerly Visual IVR) and pre-call questions, which help with caller identification. Because they used Fonolo’s cloud-based platform, the deployment was very rapid and achieved positive ROI within 60 days. (This video shows you that mobile interface in action or you can read the full case study here.)

How to Prepare Your Call Center For Spikes in Call Volume: Financial Industry

How can your financial and banking institution manage drastic spikes in call volume? We provide four ways you can prepare.